The success of any business is rooted in its ability to meet the needs of their customers by providing great service or products. In the banking and insurance industries, the same is true.

What is changing today, however, is the growing importance for banks and insurance providers to use digital platforms like websites and mobile apps to serve their customers. This change is pushing banks and insurers to design and execute digital transformation plans to meet the evolving needs of the market.

Nonetheless, there are a number of challenges that brands must overcome in order to successfully implement a digital transformation plan. Below, we detail five of them.

Technology Challenges within Banking & Insurance

Analyzing Customer Data

The first challenge that banks and insurance companies is their ability to properly collect, treat, and store customer data. From a market perspective, people today are willing to exchange more of their personal data for greater benefits in the form of monetary rewards or personalized services.

According surveys conducted by Accenture, 50 percent of insurance customers and 63 percent of bank customers are willing to provide additional personal data in exchange for benefits such as favorable premiums, lower interest rates, or other financial benefits.

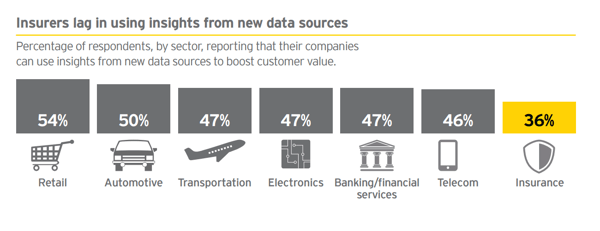

While banks and insurers collect their customers’ personal data, they often face hurdles that make it difficult for them to analyze this data to both offer the kind of personalized service that customers want and to operate more intelligently. But why?

Source: Hewlett Packard

Overall, complex artificial intelligence (AI) systems are needed to efficiently and effectively process the customer data. However, these changes have proven to be difficult as both banks and insurance companies have not been able to automate back-end process that would allow AI systems to analyze valuable data.

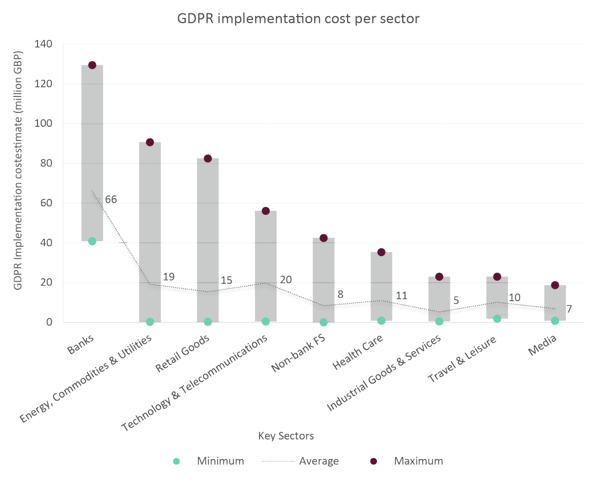

Another issue complicating data for banks and insurance companies is legislation that regulates how personal data can be collected and treated. The General Data Protection Regulation (GDPR), for example, is shaping the way all organizations collect, process, and store personal data in the European Union.

Source: Consultancy UK

As GDPR places stringent requirements on companies, using and collecting personal data can become more difficult and burdensome.

The Rise of New Competition

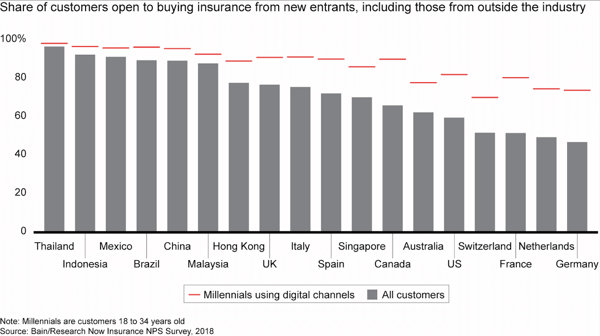

A second challenge facing banks and insurance companies is the rise of new competition in form of new online banks and insurers. Today, a significant percentage of people are willing to bank with or purchase insurance from these neo-banks and neo-insurers.

According to Accenture, 31 percent consumers would consider choosing a neobank or a tech giant like Amazon, Google, or Facebook. This figure rises to 41 percent among Generation Z consumers.

Similarly, nearly 60 percent of insurance customers are open to purchasing policies from neo-insurers or other tech companies looking to break into the industry. The percentage of customers willing to switch dramatically increases to over 80 percent when just focused on Millennials, who will continue to make up a larger portion of insurers’ customer base.

The ability to access a full range of services, products, and information online 24/7 makes these neo-banks and neo-insurers attractive, especially for younger consumers like Millennials and others that are highly comfortable using digital services.

To combat the rise of these neo-banks and neo-insurers, it is essential for established players in the banking and insurance industry to provide their customers with access to a full range of services, products, and information online.

Secondly, traditional banks and insurers will need to provide customers with additional services and play an advisory role in customers’ lives to differentiate themselves from neo-banks and neo-insurers.

According to Accenture, 48 percent of banking customers want banks to support them in an advisory role when they are in the process of making important decision such as purchasing and home, borrowing money, or purchasing a new car.

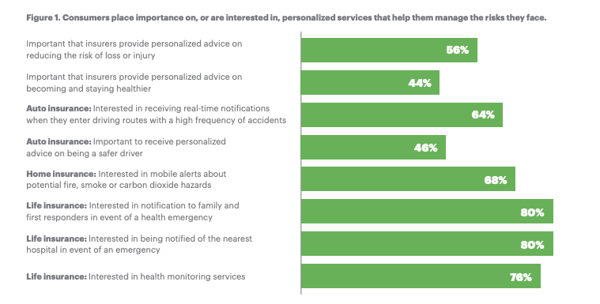

Among surveyed insurance customers, 76 percent want to receive relevant information from insurers helping them or aging family members, for example, to live longer, safer lives in their own homes.

Source: Accenture

Not surprising, insurance customers are also interested in ecosystems that provide value-added services. More than 50 percent of customers surveyed in France, Canada, and the US, and Mexico are interested in ecosystem of services as well as having an insurer be the main provider of services. These services can be viewed as a part of providing personalized services.

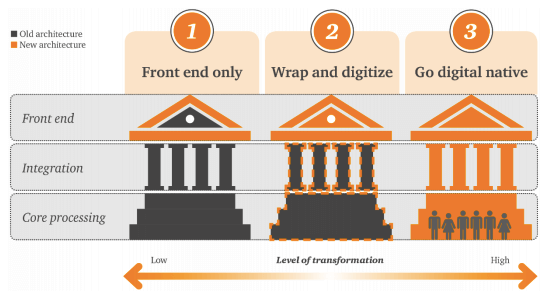

Like personal data, banks and insurance companies struggle to fully digitize their front end operations in the form of apps and websites that customers can access to purchase insurance policies, open accounts, apply for a loan, etc.

Source: PWC

Also, digitizing back-end processes in the form of automation is often difficult since it requires both specific IT skills as well as the willingness of the organization to change the culture of the workplace.

Without both, banks and insurers will not be able to offer the kind of online services that neo-banks and neo-insurers can online, nor create the kind of customer service needed.

Improving the Customer Experience

The third challenge that banks and insurance companies face is implementing or adopting innovative technology that can improve the customer experience.

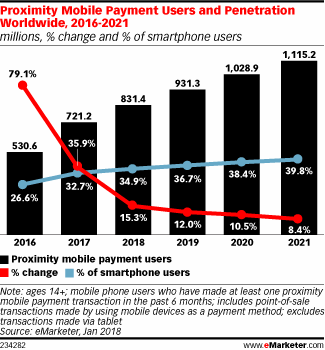

For banks, customers now have a number of ways to make purchases or transfer money that do not require them to swipe their debit or credit card. Mobile payment platforms like Apple Pay, Google Pay, PayLib, etc provide customers with an easy way to make in-store or online purchases. These services also make it easier for banking customers to send and receive money from friends or family.

The ability of customers to use these services allows them circumnavigate their bank. This, as a result, is requiring banks to adopt similar services to provide the convenience and functionality that customers seek.

Amongst, digitally active customers, 60 percent say they want person-to-person payment tools as well as contactless payment app, according to Accenture.

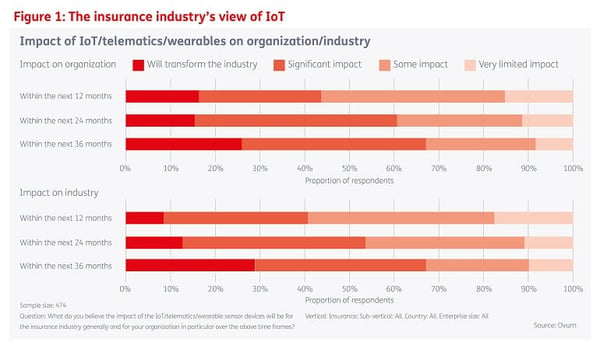

For insurers, incorporating the use of innovative technology like smart sensors or other Internet of Things (IoT) devices is important. IoT's provide insurance companies with the ability to not only collect valuable data on customers to protect them or assess their risk levels, but also to provide more personalized service to customers.

For banks and insurance companies, incorporating AI systems like chatbots or virtual assistants will be key to companies abilities to meet the needs of customers 24/7. 71 percent of bank and 74 percent of insurance customers, according to Accenture, are open to communicating with chatbots or virtual assistants to receive assistance.

Furthermore, banks and insurance companies can automate processes to improve their efficiency and maximize profitability. According to McKinsey & Company, automation in the industry can reduce the cost of processing claims by 30%. For banks, automation will handle up to 10 to 25 percent of banking functions, allowing companies divert employees to more complex and value-added tasks.

Despite the benefits, implemented AI tools like chatbots or automating processes is a current challenge that the industries must overcome.

Enhancing Cybersecurity

A fourth challenge that bank and insurance companies face is cybersecurity. Due to the type of data and the sheer amount of data being collected, banks and insurance companies must remain extremely vigilant against threats to be able to properly and responsibly safeguard customers’ data and their online platforms.

For customers, the issue of cybersecurity is a key factor in their decision when choosing a bank or insurance provider. According to Accenture, 43 percent of customers see data protection as the biggest factor in their loyalty to a bank. In the insurance industry, nearly 31 percent of customers say confidence in a brand’s cybersecurity is mainly driven by data protection.

Upgrading the Online User Experience

The fifth challenge that banks and insurance companies face is the need to launch mobile apps and websites that offer a great user experience. Furthermore, the digital services of banks and insurance companies must meet customers’ needs.

If not, their potential to reduce costs, increase efficiency, and provide better service to customers will be lost. Bugs or anomalies found a website or app can contribute to a decline in a brand’s image as well as contribute to lower conversion and higher abandonment rates.

As a result, companies across a number of industries including banking and insurance continue to devote a greater share of their IT budgets towards Quality Assurance (QA) testing.

In 2016, the QA testing market was worth $32 billion USD with a 14.9% CAGR, which was dominated by the banking, financial services, and insurance industries (36.4%).

The value of the testing market is expected to rise to 55.3 billion by 2021 . This growth is driven by automation and the arrival of new products like chatbots.

Likewise, the proportion of IT budgets allocated to QA testing continues to grow from 18% in 2012 to 39% in 2018.

QA testing in the Bank/Insurance industry is crucial for obvious security reasons but because there is no room for error when it comes to customer experience in a highly competitive sector.

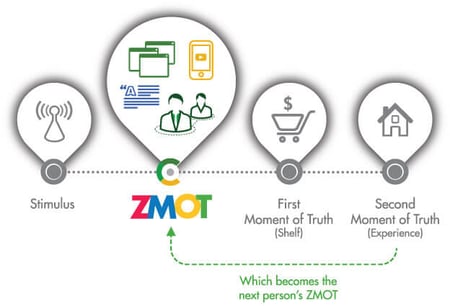

Source: Think With Google

Today, a company’s marketing approach must take into account the ZMOT, a new key moment that consists of the opinions posted online by users. A failed app or website launch is difficult to recover from, which is one of the main reasons why companies in the Banking/Insurance sector outsource part of the UAT and QA tests throughout their lifecycle of their digital platforms.

Conclusion

As banks and insurance providers continue to implement their digital transformation plan or strategy, is essential to ensure new or updated services are tested before being launched.

To learn more about QA testing within the banking sector, please do not hesitate to contact us or download our white paper below.

.png?width=470&name=Evolution%20of%20the%20QA%20Test%20Market%20(1).png)

%20(1).png?width=470&name=Evolution%20of%20the%20QA%20Test%20Market%20(2)%20(1).png)